Why traditional funding strategies are holding Asia Pacific SMBs back

Main barriers obstructing SMBs from accessing capital

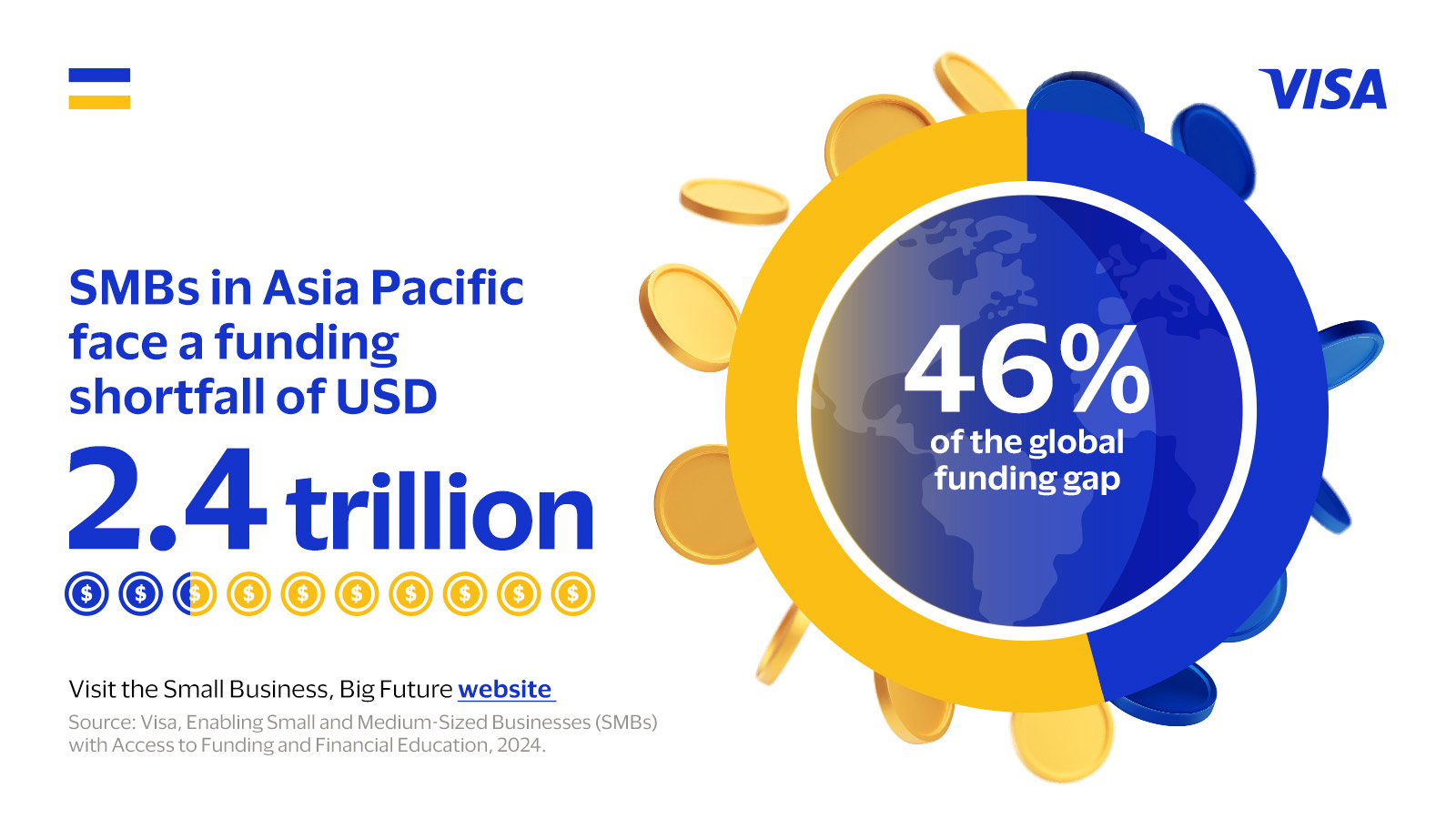

Two key factors that contribute to the SMB funding gap are limitations with traditional lending from financial institutions, and a lack of financial literacy by SMBs. The length and complexity of working capital application processes, combined with a lack of customisation, can exclude many SMBs from accessing capital they need.

Banks in the region often have lengthy approval processes for working capital applications, which can take weeks or even months. This delay is detrimental for SMBs that require immediate access to funds to manage day-to-day operations or seize timely business opportunities. For example, a small retailer may need to restock inventories quickly to meet a surge in demand, but lengthy bank approval times can result in lost sales and lower customer satisfaction.

Conventional lending can also fail to meet the specific needs and circumstances of SMBs, particularly those in emerging markets where economic conditions vary. Bank loans often require SMBs to offer assets as collateral in order to qualify for them, but smaller enterprises may not have sufficient assets to do so, excluding them from this source of capital. In addition, some SMBs may operate informally or lack comprehensive financial records, which are often necessary for banks to evaluate the loans they can offer.

Put together, the difficulties in accessing traditional sources of working capital put SMBs at a crossroads. Those in countries with less developed financial infrastructure, such as alternative financing solutions or fintech platforms that can offer micro forms of working capital for instance, can lead to significant cash flow challenges. To illustrate, if an SMB cannot obtain working capital fast enough to cover operational costs, it may struggle to pay suppliers or employees, ultimately jeopardising its viability.

Many SMBs in the region also lack the financial literacy or resources to navigate the range of financial solutions in the market. Even in developed markets where working capital solutions are readily available, this knowledge gap means business owners may not know how to optimise their working capital or worse, deter them from applying for funding and loans in the first place.

Closing the gap with innovation and government support

How can we close the funding gap in Asia Pacific? For a start, the financial ecosystem encompassing traditional financial institutions, fintech platforms, and governments are already taking positive steps to address the financial challenges faced by SMBs.

Fintech platforms are transforming access to credit for SMBs through solutions such as digital lending and micro forms of working capital. More can be done by making use of technologies like data analytics and AI, which help platforms access creditworthiness quickly and accurately via alternative data such as mobile wallet transactions, which is a boon for SMBs that may lack complete financial records.

Some do more than offer access to capital, by connecting SMBs to lenders and investors directly. For example, For example, Kiva, a crowdfunding platform with presence in Asia, allows lenders to contribute as little as USD25 to support various projects, democratising access to funding.² In 2023, Visa partnered with Kiva to benefit over 19,400 small and micro businesses with USD1.2 million in loans around the world.³

Embedded lending solutions integrate seamlessly with SMBs' existing business tools, enabling them to apply for loans directly through familiar software. This streamlined process reduces the time and effort required to secure financing, empowering SMBs to respond rapidly to market demands.

Governments are also playing a vital role in enhancing financial inclusion for SMBs through targeted loan programmes. For instance, Indonesia's People's Business Credit (KUR) programme offers subsidised loans to SMBs, with government guarantees to encourage bank lending.⁴ In Singapore, the Enterprise Financing Scheme (EFS) helps Singapore enterprises access financing more readily by sharing loan default risk with participating financial institutions.⁵ The EFS also includes specific schemes like the SME Working Capital Loan, Project Loan, and Trade Loan to cater to different financing needs.⁶

By combining fintech innovations with supportive government policies, stakeholders can create a more inclusive financial ecosystem that empowers SMBs to thrive. This will give SMBs opportunities to explore innovative and alternative solutions to overcome obstacles presented by conventional lending methods and lack of financial literacy. Embracing new approaches will allow SMBs to not only enhance their growth potential but also ensure long-term sustainability, helping them thrive in today’s evolving digital economy.

¹ Visa, Enabling Small and Medium-Sized Businesses (SMBs) with Access to Funding and Financial Education, 2024.

² Kiva, How Kiva Works, accessed September 2024.

³ Kiva, Visa and Kiva partner on most successful employee engagement campaign to date, 2023.

⁴ Kementerian Koordinator Bidang Perekonomian, Kredit Usaha Rakyat, accessed September 2024.

⁵ GoBusiness Singapore, Loans, accessed September 2024.

⁶ GoBusiness Singapore, Loans, accessed September 2024.