How the creator economy is creating new and more agile SMBs in Asia Pacific

Asia Pacific is undergoing a remarkable transformation, driven by the explosive growth of the creator economy. This new wave of content creators is reshaping how audiences consume media and revolutionising spending habits and purchasing decisions.

In 2023, the Asia Pacific creator economy reached an impressive valuation of USD135.2 billion.¹ This phenomenal growth is expected to continue at a compound annual growth rate (CAGR) of 30 per cent until 2030, reflecting a surge in creative individuals with agile working needs.²

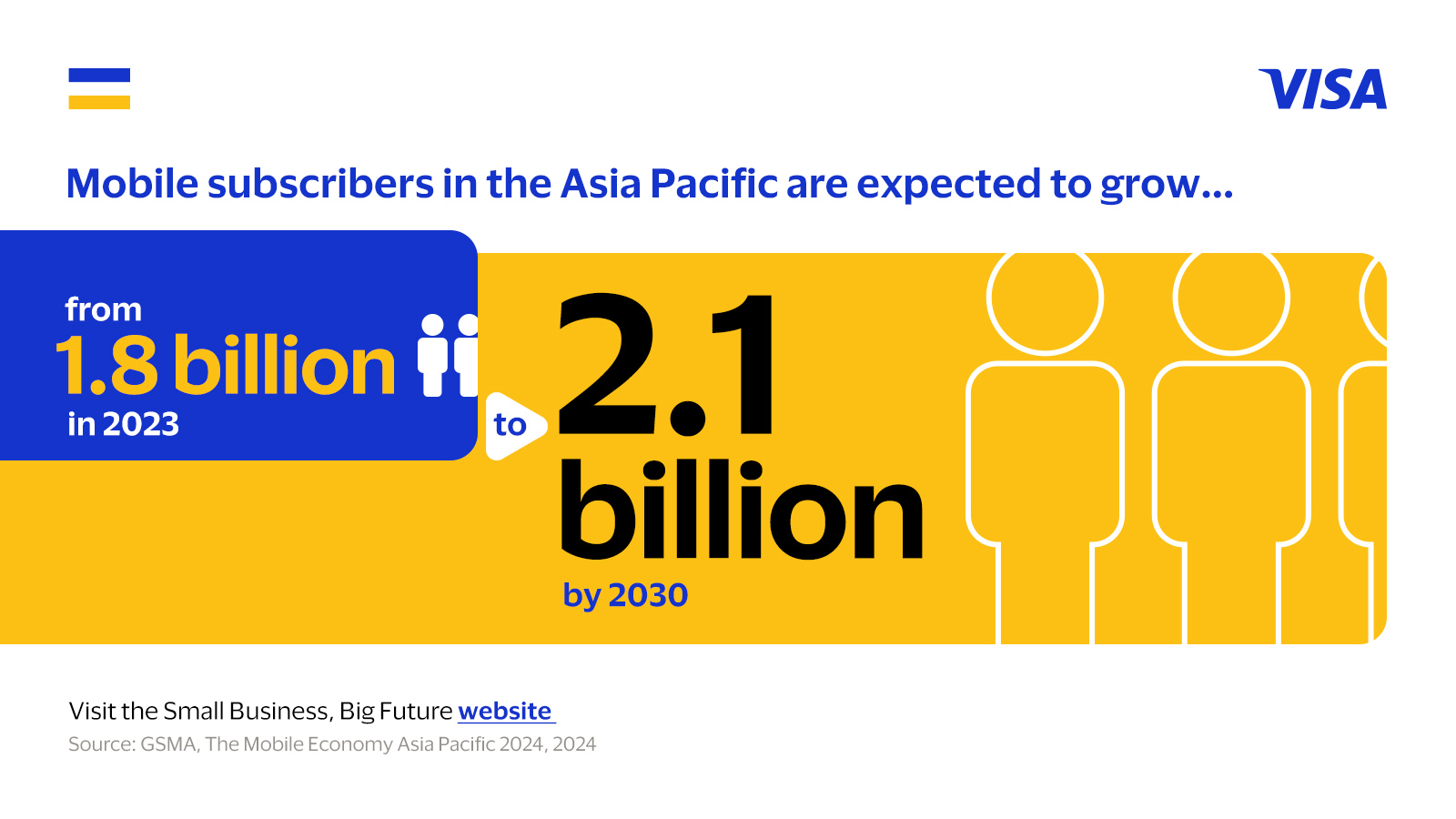

At the heart of this boom lies a fundamental shift in consumer behaviour and digital access. The region’s urbanising populations have led to increasing mobile and internet penetration. In 2023, there were 1.8 billion unique mobile subscribers, a number that will grow to 2.1 billion by 2030.³ Today's audiences are moving towards social media to consume content, spending over two hours daily on social media platforms.⁴ This insatiable appetite for on-demand content has created a fertile ground for creators to thrive and innovate.

How the creator economy is redefining SMB agility

Today, content creators have emerged as one of Asia Pacific's fastest-growing categories of SMBs. These creators function like micro-SMBs, consisting of individuals or small teams that generate revenue through the content they produce and distribute online. For instance, supercatkei, a social media personality from Singapore, has earned a five-figure income from streaming and social media content.⁵ At the same time, CarryMinati from India is the most subscribed YouTuber in the country, with an estimated net worth of USD6 million.⁶

Micro-SMBs are characterised by their small size and their comparatively fewer resources and revenues than conventional SMBs, which already are resource-constrained compared to larger enterprises. They often cater to niche markets, providing personalised services that larger companies might overlook. This specialisation allows them to build robust and loyal consumer bases. They are also remarkably able to adapt quickly to market changes as they are more nimble, being less encumbered by large teams and formal processes. Additionally, micro-SMBs play a crucial role in promoting entrepreneurship. The lower barriers to entry of setting up and monetising channels, such as social media accounts, allow underrepresented groups, like women, to build a business platform quickly and start earning.

Creators are often involved in various payment flows, receiving and sending payments among stakeholders like consumers, brands, and agencies. While this gives them the flexibility to meet more business needs and consumer preferences, the payment systems supporting creators must evolve to become more agile.

Creators are underserved by today’s payment systems

Current payment and payroll systems are typically not fit-for-purpose for today’s creator needs. These systems are not able to offer the faster payment times creators require to make a living and support the costs of multiple projects. Influencers have shared that creators’ income can be unpredictable, with delays impacting cash flow. Payment often takes 30 to 90 days, hampering creators’ ability to fund upcoming work. Furthermore, legacy systems often impose high fixed costs even for smaller transactions, driving down creators’ margins.

Like SMBs, creators can also struggle with securing business loans and accessing value-added business tools. Traditional financial institutions typically do not have financial products catered to micro-SMBs and creators, who typically carry higher risk, affecting their ability to gain access to capital. Additionally, creators can lack access to vital enterprise analytics and tools, limiting their ability to forecast or plan for the long term.

Empowering creators with flexible payment solutions

Enabling creators in today’s digital economy requires flexible payment solutions. The financial industry needs to offer agile payment and payroll systems and deliver value-added services.

Secure and efficient micropayment systems would significantly streamline content creators’ cash flow. These systems would process high volumes of small-value transactions individually, circumventing traditional systems' high fixed costs and slow processing times. To address the challenges, financial service providers can focus on developing monetisation services that are fast, locally relevant, and cost-effective, ideally offering free or minimal-fee options. Such infrastructure would enable creators to access their earnings quickly and reliably without accumulating a significant balance before cashing out.

An example of a payment solution that addresses content creators’ needs is Visa Direct. By working with banks and fintechs across Asia Pacific, Visa Direct provides fast and secure payment solutions that address the unique needs of these nontraditional businesses. It allows creators to access their earnings quickly, as fast as within 30 minutes, giving them peace of mind for their cash flow and helping them access funds to leverage viral content.⁷

Beyond basic payment processing, the financial ecosystem must evolve to offer a range of value-added services tailored specifically to the needs of content creators. These services may include payment analytics, which provides insights into earnings and financial performance, and business management tools that integrate financial services with resources for managing content and audience engagement. By combining these additional services with efficient micropayments infrastructure, financial institutions can create comprehensive ecosystems that bolster creators' growth and sustainability.

The creator economy in Asia Pacific is poised for continued growth, driven by the agility and innovation of content creators. As these creators redefine the SMB landscape with their flexible business models and diverse revenue streams, financial institutions and fintechs must overcome the limitations of legacy payment systems. By integrating value-added services such as micropayments and financial analytics, more solutions will be available to empower the next wave of agile SMBs in the creator economy, fostering sustained growth and economic impact across the region.

¹ Campaign Asia, When creator content goes mainstream, 2024.

² Visa, Empowering Agile SMBs through Innovation and Entrepreneurship, 2024.

³ GSMA, The Mobile Economy Asia Pacific 2024, 2024.

⁴ Visa, The Creator Economy, 2024.

⁵ Mothership, S’porean, 25, becomes top live streamer in Asia in 2 years: ‘Most people think it is very easy & simple’, 2023.

⁶ Lifestyle Asia, 9 richest YouTubers in India who have earned a fortune through their videos, 2024.

⁷ PYMNTS.com, Visa Aims to Turn Creators into Small Businesses with Digital Payments, 2022.